Cryptocurrency is steadily growing acceptance in Africa. Similarly, the use of cryptocurrency for money transfers to Africa is also on the rise.

Fintech companies use cryptocurrencies such as Bitcoin to mitigate problems associated with traditional money transfers to Africa and within Africa such as high fees.

Africa is the most expensive region to send money to in the world. Intra-Africa money transfers are even higher than sending money to Africa. Sending money from South Africa, for instance, is double the global average. The use of cryptocurrency-powered money transfers is expected to lower these high costs.

Remittances are a significant source of income for African countries. In 2019, Sub-Saharan Africa received $48 billion, which accounted for 34% of GDP in South Sudan, 20.1 in Lesotho, 10.7 in Senegal, and 15.6 in The Gambia.

Cryptocurrency Transfers Are on the Rise in Africa

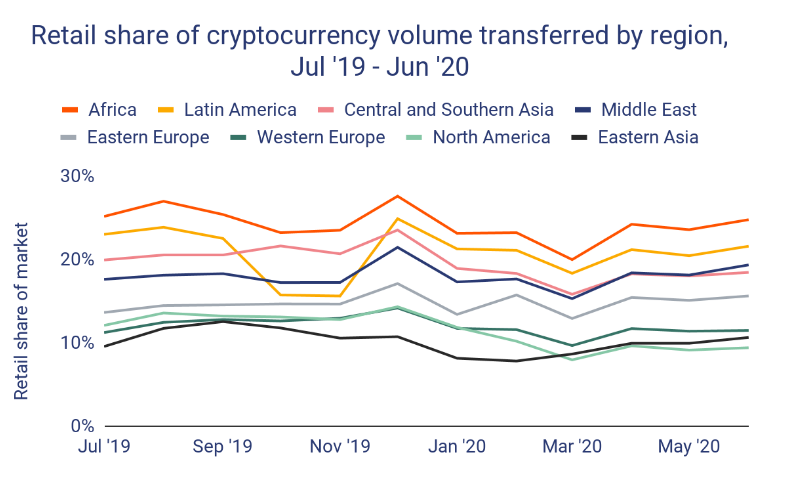

According to blockchain research firm, Chainalysis, monthly retail cryptocurrency transfers to and from Africa reached $316 million in June, 2020 alone. Leading countries in Africa for cryptocoin transactions are Nigeria, South Africa, and Kenya.

According to Credit Suisse report in January 2020, Western Union has been testing Ripple and XRP in the belief that cryptocurrency has the potential to shorten transfer speed and generate savings.

African tech innovators and entrepreneurs are among those at the forefront of crypto money transfer space. Leading African fintech companies using cryptocurrency to send money to Africa include BitLipa, Cryptofully, BitPesa, Bitsika, Bitkesh, and Paychant.

These companies, located in Kenya, Nigeria, South Africa, and Ghana, may make cryptocurrency dominate African money transfer market in the future.

Advantages of Cryptocurrency Transfers to Africa

Crypto transfers bring many advantages in the international money transfer industry. For example, they will lower the fees while increasing the speed of a transfer. If the receiver will keep their cryptocurrency and spend it without conversion to the national currencies, it can also help safeguard them against currency depreciation and price fluctuations in their national context.

Fees

While sending $200 to Africa using fiat money costs 9% on average. Bitcoin fees are usually below 3%, the percentage the United Nations’ Sustainable Development Goals aims to reach by 2030.

For cryptocurrency companies such as Coinbase and Bitkesh, there are no fees to send or receive money. For any crypto transfer up to $300 using the crypto transfer fintech, Bitsika, there are no any fees.

Bitsika doesn’t add a markup on exchange rate. Bitpesa on the other hand charges a 3% remittance fee regardless of the amount involved in the transaction.

Speed

Speed is one of the key factors when it comes to efficient international money transfers. Some traditional money transfer companies charge extra fees for faster transfers. There are also delays caused by banking holidays and wire transfer cut off times.

Most crypto transfer firms implement instant transfers with no extra fees. Sending XRP using Coinbase, for instance, takes 3-5 seconds while USDC takes 12-17 seconds. With cryptos, you can send money any time and any day of the week.

Currency Depreciation

Many African currencies regularly experience instability and depreciation. The Zambia Kwacha, for example, was the world’s third-worst currency performer in 2019 while the South Africa Rand has lost over 50% of its value against the U.S. dollar in the past ten years.

As a result of the coronavirus pandemic, all African currencies, except for the Malawian Kwacha, depreciated against the US dollar. Luckily, cryptocurrencies such as Bitcoin are deflationary because of its limited supply while stablecoins are linked to stable currencies.

Price Fluctuation

Several factors such geopolitics, demand and supply lead to fluctuation in currency prices. Stablecoins such as Binance USD, Tether, and USD Coin are designed to minimize price fluctuation risks. Stablecoins are pegged to a stable currency like the U.S. dollar or to a commodity’s price such as gold.

Currency Conversion

Currency conversion usually comes with hidden fees in the traditional money transfer market. Most companies add hidden fees in the currency exchange rates. With blockchain powered services,, individuals can save on conversion fees when sending money to Africa.

Final Thoughts

Remittances are a significant source of foreign income into Africa. They play a great role in helping families meet their basic needs such as food, clothing, and healthcare. They also enable small scale farmers to buy important farm inputs during the farming season and allow families to send their children to school.

However, the cost of sending money to the continent remains the highest in the world. Hopefully, cryptocurrency and blockchain technology can reduce the cost and allow African migrants to send more money to their families and friends.