African leaders have approved the establishment of a $20 billion continental financial stability fund.

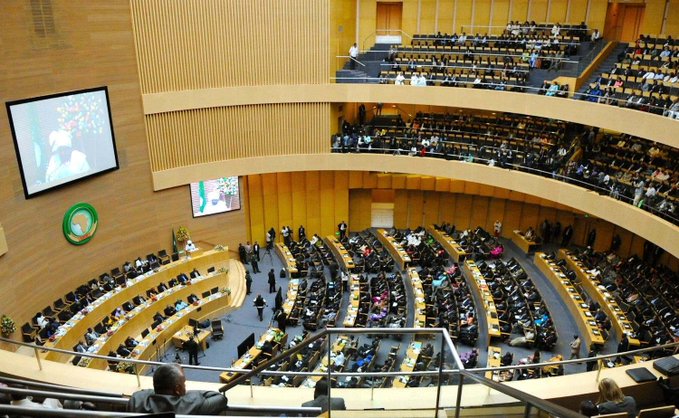

The decision taken by the African Union summit in the Ethiopian capital over the weekend seeks to stave off potential debt crises on the continent .

The facility, known as The African Financial Stability Mechanism (AFSM), will get its own credit rating to allow it to borrow on international capital markets, said in a statement Reuters reported.

In a statement the African Development Bank (AfDB) said, African leaders had called for the creation of the fund in February 2022 and mandated the AfDB to carry out preparations to set it up.

According to the statement, the AfDB now intends to move quickly in drafting a formal agreement and securing ratification by states.

As well as soaring external commercial repayments and the risk of default, many economies in the region are also grappling with pressure for higher spending, sluggish government revenues, and the effects of climate change.

Creation of the facility was also partly motivated by the fact that Africa lacks its own regional financial cushion, unlike Europe and Asia, which have arrangements of this kind.

“If implemented as designed, the AFSM can save African sovereigns approximately $20 billion in debt servicing costs by 2035,” Kevin Urama, an AfDB vice president and its chief economist, told Reuters.

Membership will be voluntary and open to any African Union member country willing to participate.

Provision has been made for at least 20% of non-African members provided the African states retain the majority of membership.

Intron Health raises $1.6M in pre-seed funding to build AI for Global Health

Source: Africafeeds.com