Facebook’s messaging service WhatsApp on Monday announced that it has launched its own payment system for users.

In a blog WhatsApp said “We’re excited to announce that starting today (Monday) we’re bringing digital payments to WhatsApp users in Brazil.

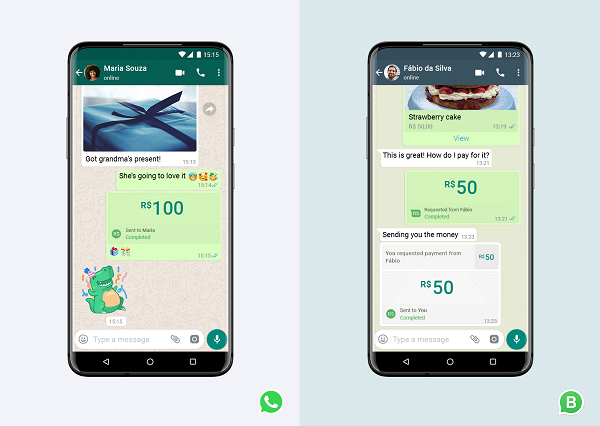

The write-up said “People will be able to send money securely or make a purchase from a local business without leaving their chat.”

According to WhatsApp “over 10 million small and micro businesses are the heartbeat of Brazil’s communities. It’s become second nature to send a zap to a business to get questions answered.

Now in addition to viewing a store’s catalog, customers will be able to send payments for products as well. Making payments simple can help bring more businesses into the digital economy, opening up new opportunities for growth.”

WhatsApp said it intends making “sending money to loved ones as easy as sending a message, which could not be more important as people are physically distant from one another.

Because payments on WhatsApp are enabled by Facebook Pay, in the future we want to make it possible for people and businesses to use the same card information across Facebook’s family of apps.”

The Tech company assured that it has “built payments with security in mind and a special six digit PIN or fingerprint will be required to prevent unauthorized transactions.”

It is starting this payment system with support for now available for “debit or credit cards from Banco do Brasil, Nubank, and Sicredi on the Visa and Mastercard networks.”

WhatsApp said it is also “working with Cielo, the leading payments processor in Brazil. We have built an open model to welcome more partners in the future.”

Using the platform to send money or make a purchase though is free for people, according to WhatsApp.

It however said “businesses will pay a processing fee to receive customer payments, similar to what they may already pay when accepting a credit card transaction.”

The company said it hopes to roll out the system to everyone across the world “as we go forward.”

Source: Africafeeds.com